t mobile taxes and fees california

T-Mobile Connect as its known will be available for everyone starting this Wednesday March 25 2020. At the end of 2019 over 67 percent of low-income adults had wireless as their phone service and 58.

These taxes fees and surcharges were combined under a single Prepaid MTS Surcharge.

. I was charged 14900 for the consumption of 990MB of roaming from the dates Jan 21 till Jan 30. T-Mobile has long taken great pride in and made a big advertising fuss of its no-taxes-and-no-fees policy but while thats obviously a real thing that applies to the standard cost of the Un-carriers wireless and even home internet plans add. Its just 55 per month for two lines with Autopay plus taxes and fees just 40 for a single line and includes everything that comes with T.

With the Essentials Magenta 55 Plus plan with Autopay its about. If your payment does not go through for any reason. 1787 rows Prepaid Mobile Telephony Services MTS Surcharge Rates effective April 1 2020.

We pay certain taxes to state governments give you service. However T-Mobile also plans. LTE unlimited but throttled after the first 500 MB and unlimited talk and text then 152 USF fee and 100 e911.

This isnt strictly a T-Mobile development but I received a text message this morning from T-Mobile notifying me that California is adding new taxesfeessurcharges to all mobile prepaid plans starting in January and it provided me with a. T-MOBILE ESSENTIALS taxes and fees additional INDIVIDUAL FAMILY 2 lines minimum ADD-A-LINE 36 lines. However wireless taxes have increased by 50 percent from 151 percent to 226 percent of the average bill.

GoogleVoice domestic call forwarding and cheap intl. If you want to change your mobile number T-Mobile makes it very easy but they will charge you a hidden fee of 15 every time you change your number. This isnt a tax that the state requires us to collect.

This will appear on your bill as One time charge for MSICHG. This appears on your bill as Restore from Suspend. Calls Use GV to give us a home number in a 2nd location.

As has been the case in the last three years the FUSF increase from 98 percent in 2020 to 118 percent in. But its T-Mobiles fees that remain a mystery. Introduction Taxes and fees on the typical American wireless consumer increased again this year to a record 2496 percent.

I started with T-Mobile prepaid back in July of last year. Tmobile taxes and fees in California. See Account suspensions for more details.

Rebate on 7 lines for low data use. 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21. But hey every little bit counts.

According to the consumer tax and spending think tank Tax Foundation average cell phone service fees and taxes have reached 186. 8 T-Mobile lines - Unlimited talk and text data. Tmobile taxes and fees in California.

T-MOBILE ESSENTIALS taxes and fees additional INDIVIDUAL FAMILY 2 lines minimum ADD-A-LINE 36 lines. 20 per line for the first three lines plus tax and is due when you restore service after a non-payment service interruption. ATT Phone Administrative Fee.

This number also represents a 45 increase in these extra fees over the past decade. T-Mobile does not have a Grace Period for late payments so if you are a day latea fee will show up on your bill. TMobiles fees are roughly 5 for 2.

It varies depending on the amount owed and your delinquency - at a minimum it will be 5. 7 lines not available MONTHLY COST 60 with 5 AutoPay discount Taxes and fees additional 30 with 5 AutoPay discount Taxes and fees additional 15. We charge you the State Cost Recovery Charge as a percentage-based fee to cover some of these costs.

I dont know if that was a tax or a fee but I paid it. If you are required to return a device to T-Mobile you have to mail that device within. During the period between 112016 and 12312018 prepaid wireless sellers were required by California law to collect certain taxes fees and mandatory surcharges from prepaid consumers at the time of purchase.

Taxes cant really tell you but they fluctuate depending on the government. T-Mobiles Essentials plan will cost 120 for four lines 30line while T-Mobile ONE goes for 160 40line. The Phone Administrative Fee is a per-line per-month fee.

This total includes state and local taxes averaging 1316 percent and the federal Universal Service Fund FUSF rate of 118 percent. The actual amount you pay your carrier shouldnt change. Mobile number change fee.

Starting this month however it is charging me 355 to refill which is a lot more. Thanks gramps28 I didnt have much luck with googling before posting here sites info either didnt have a date or were old. To refill online it cost me 75 each time.

This means that wireless customers are paying an average of 225 per year above and beyond the actual price of their mobile service. I contacted T-Mobile 8 times since Feb 5 and I havent been able to resolve the issue. It wont be a lot an example provided by T-Mobile showed total taxes and fees reduced by about 3.

The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 Level AA success criteria published by the Web Accessibility. My International Data plan was good for the dates Jan 17 till Feb 17. Net cost about 185-190mo.

313 rows Since 2008 average monthly wireless service bills per subscriber have dropped by 26 percent from 50 per line to about 37 per line. 35 or maximum allowed by law. Companies can charge what they like for those.

Anyway I think I can figure out taxes. Prepaid Mobile Telephony Services MTS Surcharge Rates effective April 1 2022. 30 per line for activations in Assisted Channels.

The plan remarkably starts at. He then advised to contact 611 which I did. My bill is due on the 22nd of February.

5 Tax Deductions Entrepreneurs Need To Know Business Blog Money Blogging Blog Tips

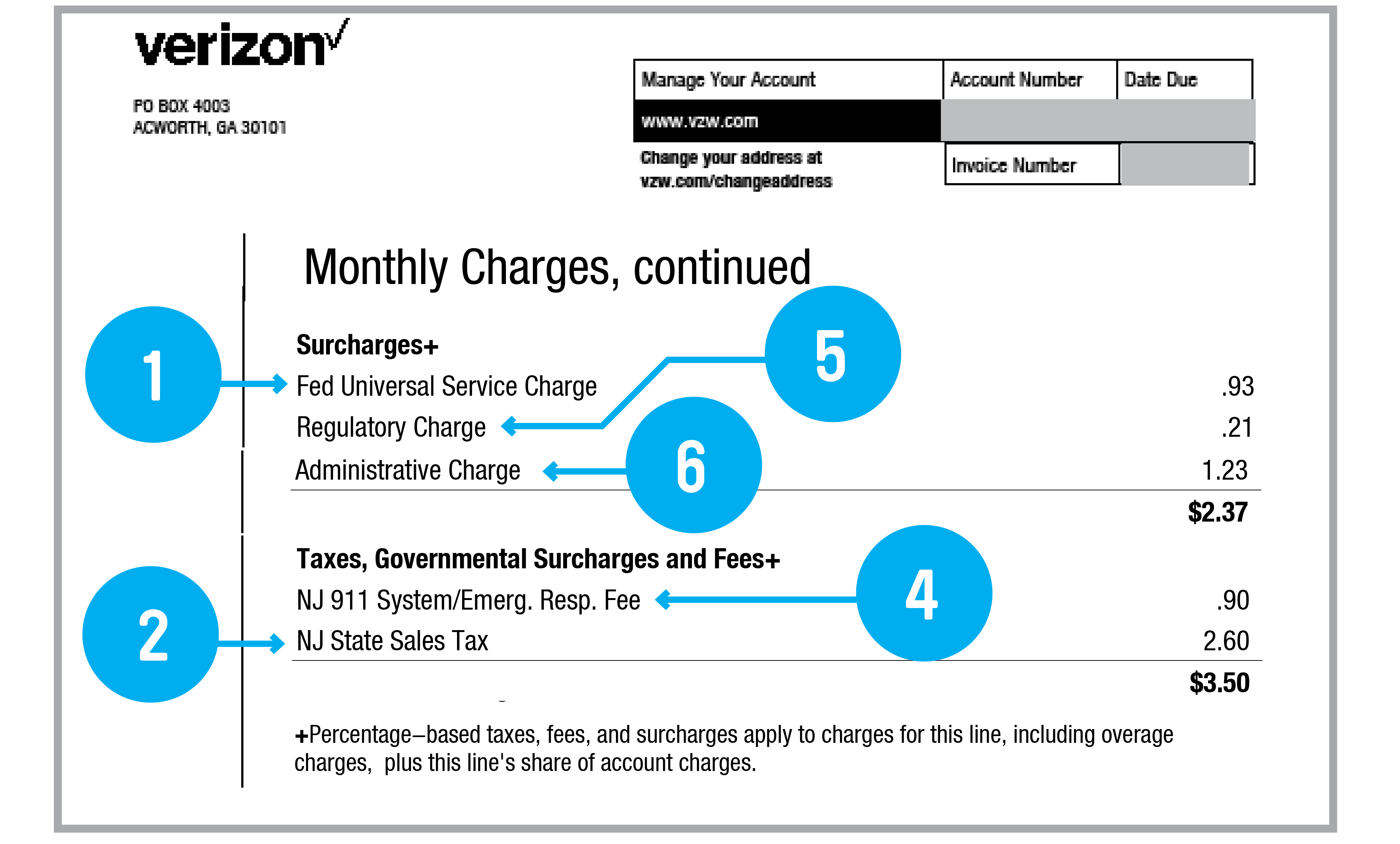

Verizon Wireless Cellular Mobile Phone Bill Statement Monthly Plan Utility Proof Address Cell Phone Bill Phone Bill Verizon Phones

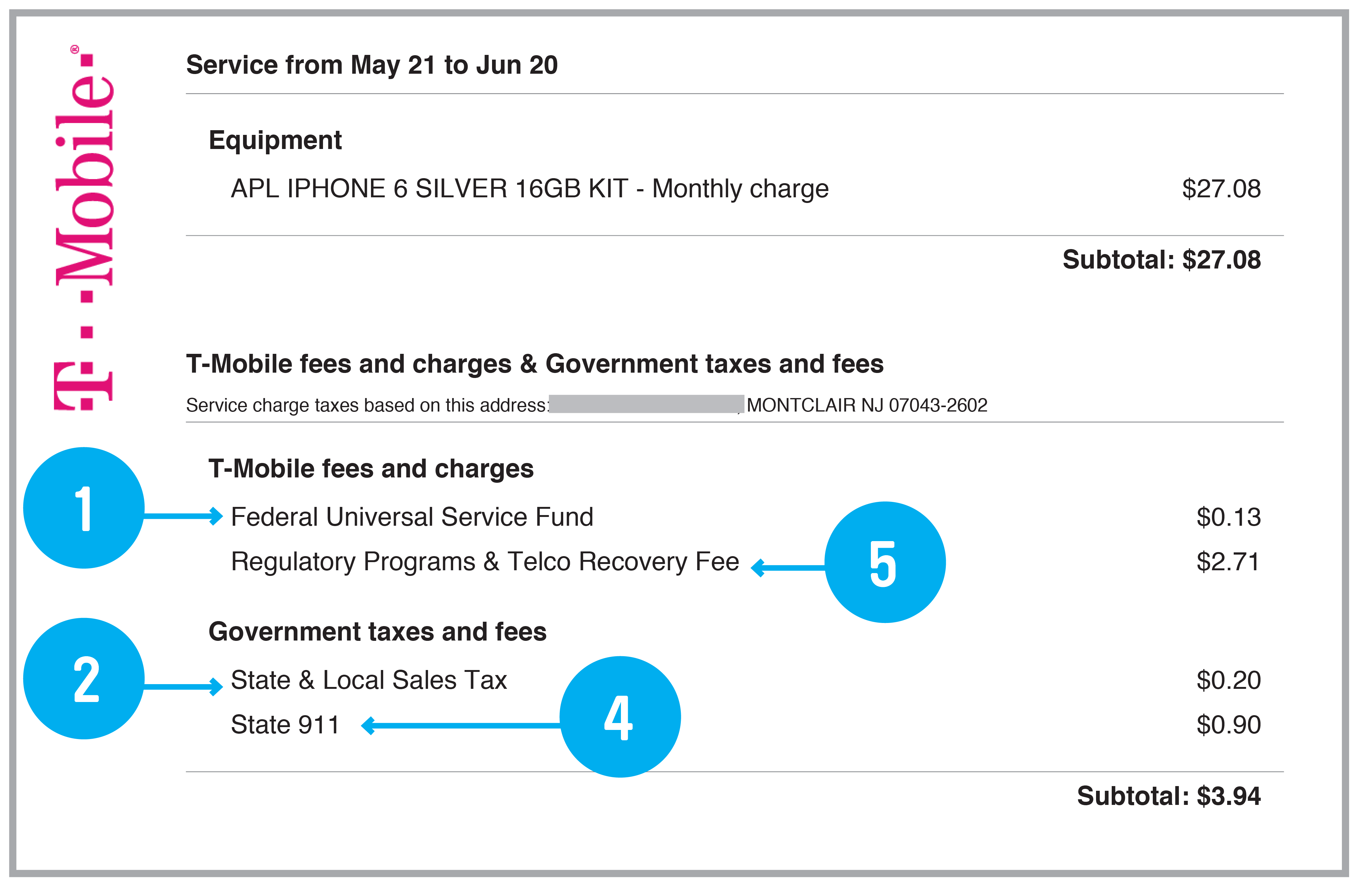

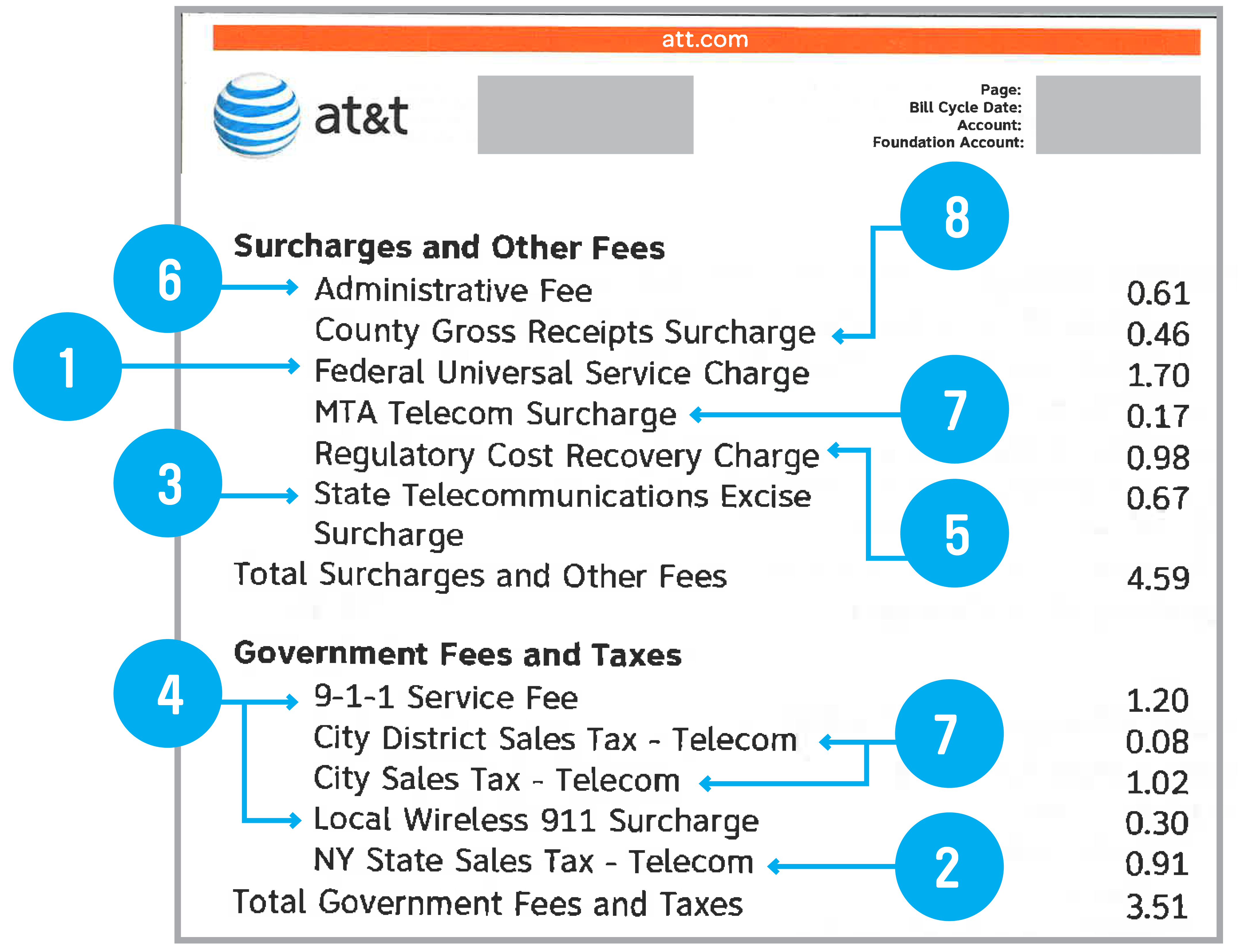

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

Pin By Jon Schlussler On Taxes In 2021 Irs Learning Publication

New To T Mobile T Mobile Support

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

Understanding Hidden Fees In Your T Mobile Bill Fairshake

T Mobile Vs Verizon Vs At T The Ultimate Plan Comparison

Don T Get Tricked Into Paying This Extra 40 Tax Return Fee Free Tax Filing Filing Taxes Online Taxes

Ee Wireless Uk Eu Id Card Template Doctors Note Cps Energy

Different Types Of Company Incorporations Adhere To Different Types Of Tax Structures Etc Check Our Website Htt Types Of Taxes Understanding Yourself Company

Taking Tax Return Prep Down To 10 Minutes Tax App Turbotax Mobile App

5 Income Tax Tips For Notaries And Signing Agents Notary Notary Public Business Mobile Notary

Verizon Logo Design History And Evolution Logo Realm Verizon Wireless Google Pixel Phone Youtube Traffic

Turbotax Tax Preparation Software Free Tax Filing Efile Taxes Income Tax Returns Tax Software Free Tax Filing Online Taxes